Why You Should Be Submitting Superbills for Your Patients

We think 2019 is going to be the year of the superbill!

Being in the healthcare sphere, we’re sure you’ve heard of superbills before—but are they something your practice provides to your clients?

If not, we’re here to tell you that you should seriously consider integrating them into your billing process.

We know they sound like some kind of fictional hero, but capes and masks aside, superbills really can be a savior for both your patients and insurance companies.

In this article, we are going to explore the purpose of a superbill, what its benefits are, and how IntakeQ can help make them a part of your customer experience.

What is a Superbill?

In case “superbill” is a new term to you, we’ll give a quick overview of what a superbill actually is.

Think about it as an itemized form of services that a patient received from your practice. Much like a hotel bill, it lists out the individual items, costs, and codes for each exam, treatment, or procedure.

The purpose of a superbill is to break down a patient’s bill so that their insurance company can properly review, process, and cover claims.

Unlike a regular invoice that you may send to a health insurance company or patient, a superbill may also include additional information about a visit (such as a diagnosis) that might warrant an insurance provider to cover a certain procedure or service.

Benefits of Superbills

Though superbills aren’t mandatory, they can be a great deal of help when your patient is looking for optimal coverage from their insurance provider. More detail is better when it comes to complicated healthcare bills, and including as much information as possible could help the patient receive additional coverage or fall under a specific category.

And that’s no small thing. According to Becker’s Hospital Review, a recent study conducted by the Kaiser Family Foundation “found that two-thirds of respondents are either ‘very worried’ (38 percent) or ‘somewhat worried’ (29 percent) about being able to afford unexpected medical bills for them or their family. That compares to the 53 percent of insured respondents who reported they are very or somewhat worried about being able to afford their health insurance deductible, and the more than 40 percent of respondents who reported they are very or somewhat worried about affording prescription drug costs.”

Of course, a patient who pays less is a happy patient. And a happy patient can potentially become a loyal patient, so it’s in your practice’s best interest to make the process as easy as possible for the patient or client.

This will help you secure repeat clients or even new clients when the satisfied patient refers you to a family member or friend, or provides a positive online review.

How to Make a Superbill

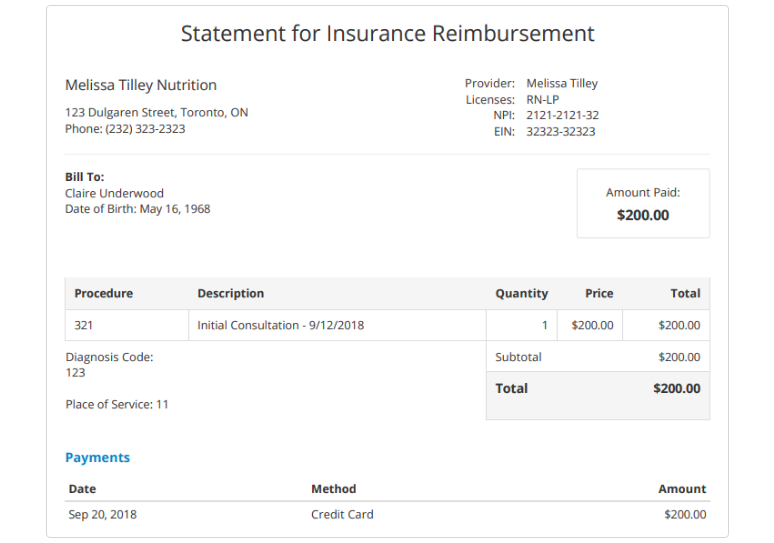

In order for a regular bill to become “super,” there are a number of elements you need to provide in addition to the normal basics. Certain specifications, codes, and details are required so the insurance provider can fully assess the charges.

Though superbills may differ a little depending on your area of specialty, below we walk you through everything you should include in your patient’s superbill.

Personal Information

And by personal information, we just mean the necessary patient identifiers. This will include the patient’s full name, date of birth, insurance plan on file, and date that the superbill was issued. It’s also a good idea to have the patient’s address and phone number included.

Appointment Information

This is the critical part of the bill, where each component of the visit is detailed for the insurance provider. Of course, making sure to accurately note the date of the patient’s visit is very important.

And, in order for a superbill to really earn its title of “super,” appropriate medical codes for both procedures and diagnoses must be included. These codes are maintained by professional groups as detailed below:

– Diagnosis Codes & Descriptions (ICD-11)

ICD stands for “International Classification of Diseases” and is copyrighted by the World Health Organization (WHO). It is marked with “11” to distinguish itself as the 11th revision, which is the most current.

This system includes the proper codes for diseases and symptoms. You can check it out by visiting WHO’s website.

– Procedure Codes & Descriptions (CPT)

In the United States, CPTs (short for Current Procedural Terminology) are issued by the American Medical Association. These are used to describe any procedure that a provider might perform on a patient. These five-character codes are used by insurance companies to determine the amount of reimbursement that a practitioner will receive for services provided.

As highlighted by the AAPC, there are three categories of codes:

– “Category I – These five-digit codes have descriptors which correspond to a procedure or service. Codes range from 00100-99499.

– Category II – These alphanumeric tracking codes are used for execution measurement. Using them is often optional.

-Category III – These are provisional codes for new and developing technology, procedures, and services. The codes were created for data collection and assessment of new services and procedures.”

Modifiers

Modifiers are necessary when a procedure or service needs to be altered in some way to better serve the patient, but still would remain under the original CPT code. Essentially, they are used to further explain a CPT code to the insurer.

Modifiers can be quite tricky, and aren’t always used in the right way, which can cause the denial of a claim. However, they can be critical in getting appropriate compensation, so it’s important for your billing staff to be properly educated in modifiers and have sufficient resources available.

Fees

Alongside the individual CPT codes, a breakdown of all associated fees should be included. This helps the insurer (and even the patient) understand exactly what is being charged and why.

This detailed accuracy not only will help your practice receive as much reimbursement as possible from approved claims, but it could also significantly help the patient pay less out of pocket since their coverage plan is being optimized.

How IntakeQ Can Help

Did you know that you can now create superbills for your clients that they can then submit to their insurance provider? Yep, that’s right!

You can even customize your practice’s system to accommodate multiple practitioner accounts, keeping things equally organized and convenient.

We make it really easy to add or edit diagnosis codes and procedure codes, and add them to specific clients or services.

Once your superbill is complete, you are then able to print or download the superbill as a PDF, email the PDF to a client, or send it to the client via our secure client portal.

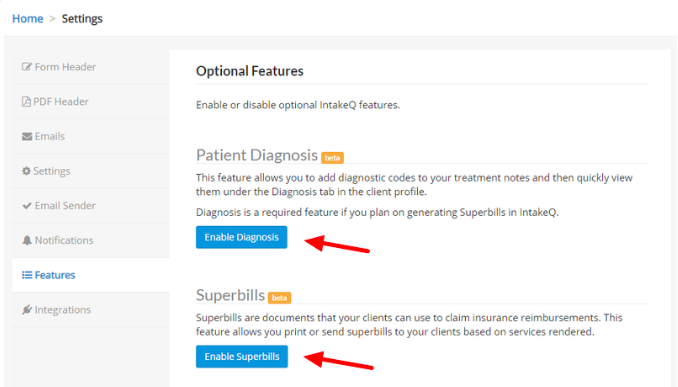

To enable your superbill feature, follow these steps:

- Navigate to “More > Settings > Features”.

- Click the “Enable Diagnosis” and “Enable Superbills” buttons as both features are required for superbills (see image below).

Need help getting started? Click here for a step-by-step guide on how to create superbills using IntakeQ.

Need more help understanding superbills? Check out our quick and easy guide.

The Bottom Line

Superbills aren’t just something you could do for your patients, but rather they are something that you should do for your patients.

Making everything clear, coded, and organized will only help insurance providers process and approve claims, ensuring that your practice is compensated appropriately while the patients are appropriately covered by their plans—after all, that’s the whole purpose of health insurance!