Dos & don’ts of a sliding fee scale

You’re good at what you do, and you’re in business to make money as you provide valuable services. But whether you’re in healthcare, dentistry, legal or other fields, you also have a mission — a commitment — to help others. So what do you do if clients can’t pay your regular rates due to financial hardship? Do you turn them away, or offer alternatives you both can live with?

There are pros and cons — and associated dos and don’ts — for customizing your fee structure based on a client’s needs. In particular over the last few years, some people have experienced financial, emotional or medical needs they can no longer afford to fully meet. Some have lost jobs and insurance while prices for everything from gas to groceries have risen. (Of course, your practice’s costs haven’t exactly gone down either, something to keep in mind in this thought process.)

But do you sometimes negotiate a “break” to help clients get the services they so desperately need? And what does that mean for your other patients and plans paying your regular rates? (That’s called cost-shifting or even price-gouging; more on that later.)

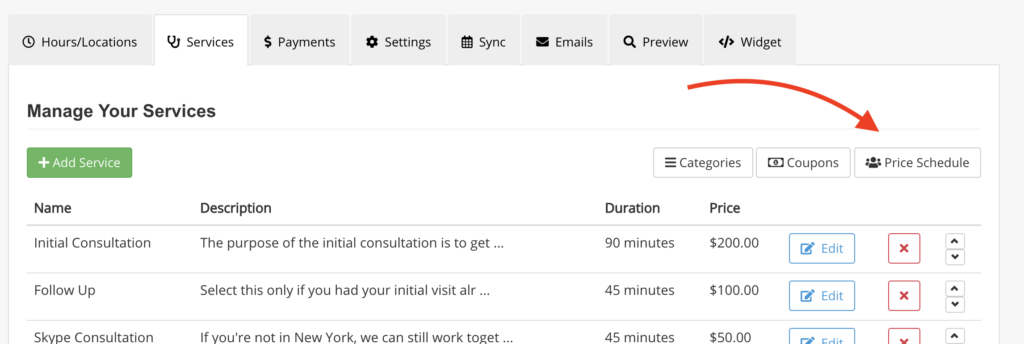

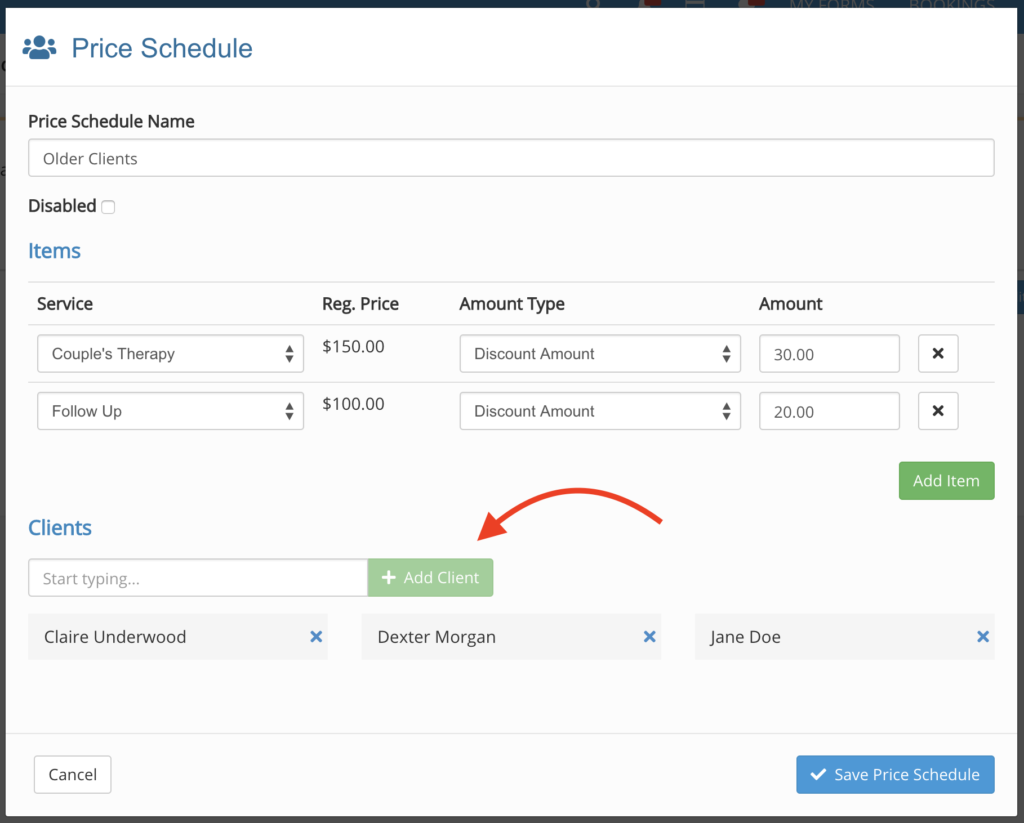

Many providers do make select adjustments based on need. Some choose a case-by-case basis, and practiceQ™ can help you easily do that. As you’ll see below, you can set up a discount amount or percentage for some services or a fixed price for certain services for select clients or groups of clients (such as older customers or those without any insurance).

But there are some things you should think through first. As in life in general, any practice-related decision comes with consequences. Some that may be good for clients may be bad — even illegal — for you. As the phrase implies, a sliding fee scale can indeed become a slippery slope. Here are some things to do…or not do…to consider so you can optimize any fee-schedule adjustments for all parties.

DO

…adhere to your insurance contracts.

Typically, you can’t charge an insured client less — or more — than you and the insurance company have contractually agreed to. Most insurance contracts forbid you from charging a cash-paying client a lower fee than you agreed to charge the insurance company. You can check with the company for permission, but that’s likely to be a long, frustrating and unfruitful experience. And the time spent on it also has an administrative cost to your practice.

Like most other DOs, this one definitely comes with a DON’T: Discounts or waivers for healthcare patients on Medicare, Medicaid, the Children’s Health Insurance Program (CHIP) or other federal- or state-supported medical programs are typically illegal and can even be considered fraud. It can lead to HHS fines or exclusion in Medicare and Medicaid programs. Some states do have certain waivers for specific services under Medicaid or CHIP.

However (and this is a good however).

Note that the Office of the Inspector General (OIG) of HHS has made it clear through a Special Advisory Bulletin (PDF, page 3) that “non-routine, unadvertised waivers of co-payments and deductibles based on individualized determinations of financial need or exhaustion of reasonable collection efforts” are among the few exceptions to this prohibition.

Notice two key words in that statement: non-routine and unadvertised. So if you discount co-payments or deductibles for any Medicare patients, for instance, don’t do it often, and don’t promote it at all. Otherwise, it can look as if you’re seeking to gain business by promoting discounts as part of your marketing.

Again, check your insurance contracts, and consider contacting your lawyer to help ensure you’re on solid legal ground as you work to do the right thing for your client(s).

DO

…establish standard, written policies for pricing. And follow them.

Taking a page out of the Realtor market (location, location, location), the mantra in healthcare and legal is document, document, document. Establish written guidelines for when your practice is willing to reduce or defer fees based on recognized standards, such as income X times above or below the last year’s federal poverty rate, or perhaps the poverty level in your area.

It’s always important to discuss your fee structure with each client up front. If a new client expresses concerns due to their financial hardships, that discussion opens the door to a discussion…especially if you’ve established a sliding fee. At that point, some providers choose to ask for proof of income for clients seeking a lower rate, while others trust clients to share truthful information regarding their finances.

If you establish a policy that the client in question should provide proof of income, determine ahead of time what that entails…last year’s income tax return, two to four recent pay stubs, etc. Regardless, as you do with all clients, have the person sign that they acknowledge their financial obligation, whatever it may be, and that fees may change at any time.

DO

…hold discussions on the front end, but know that “change” happens.

Certainly, there are situations that arise down the road, even with long-standing clients. But as noted, whenever possible have the discussion about fees up front if a potential new customer raises concerns. That helps establish a clear understanding of what you are (and are not) willing and able to do, what proof of income and expenses you may require, and have any understandings signed. Hopefully for their sake and yours, whatever financial bumps in the road that occur once the relationship has begun will be short-term situations.

DON’T

…set yourself up to be accused of price-gouging.

You wouldn’t typically think of price-gouging when you’re looking at discounts for certain clients under established practice guidelines. But that is, in effect, what you’re doing; you’re charging more for some patients—those with better insurance or income—than for others. In case a client asks how you established your price structure for a therapy visit, for example, have a sheet available to help explain how you determined it and how people qualify.

If you’re not sure whether your sliding fee scale meets ethical guidelines, it doesn’t hurt to talk to an attorney or other legal expert.

DO

…consider offering financial-support programs.

There are certain programs available that can help provide clients with financing support, including some programs specific to medical or dental clients. Also, you can also provide a list of social service agencies where a client in need may be able to seek assistance. Share this information as needed, so clients can follow up, but it’s typically their responsibility, not yours.

Especially for established clients who have what appears to be a short-term financial setback, you may choose to have them continue a therapeutic plan and pay only a small portion of your regular fee, with the remainder put on an agreed-upon payment plan. You may also choose to keep your full fee schedule but offer a limited amount of pro bono services.

Again, these options should all be evaluated and articulated in any overview of your sliding-fee structure.

DON’T

…overlook the potential impact on your practice.

Bottom line, discounting your pricing structure means reducing your revenue. But since your operating costs won’t decrease, your commitment to your stated mission will impact your bottom line.

Reducing income can also mean you and your staff work longer hours. That affects your work/life balance while it also increases your other operating costs for things such as power for lighting and HVAC.

Before you consider a sliding-fee structure, it’s important to perform a financial audit to determine how many clients you can afford to see on a reduced-fee basis without suffering adverse consequences. Without being heartless to your clients’ needs, you DO need to keep the well-being of yourself, your family and your staff in mind as well.

A final point

While you’re under no obligation to provide any kind of sliding-fee structure, it is worthy of thoughtful consideration as part of your mission and the ongoing success of both your clients your practice. Remember…if you go out of business, you can’t help anyone. By keeping all of those things in mind as you establish any sliding fee scale, you and your team will have something to refer back to consistently, rather than dealing with every one-off situation as they arise.

Again, practiceQ makes any fee structure simple to implement, whatever you’ve decided for a single client or a select group of clients who meet your established criteria.