7 ways to help inflation-proof your business

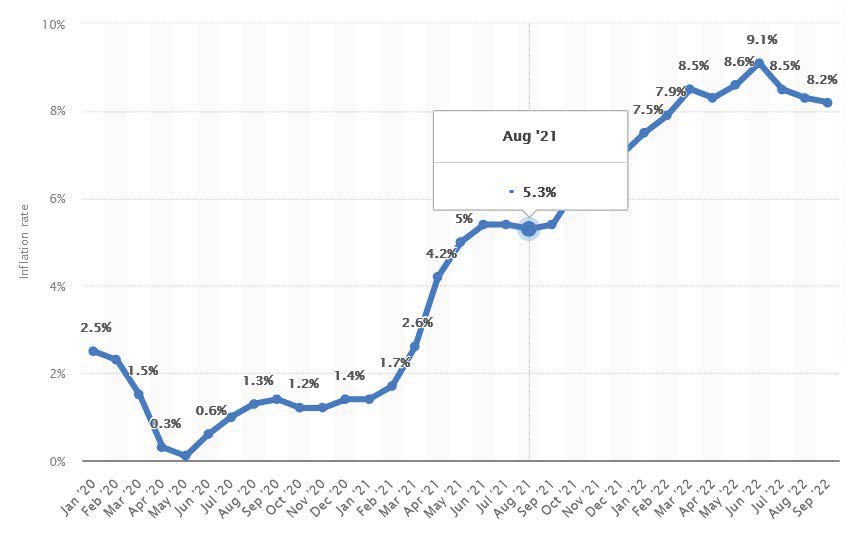

It’s been a hard few years, both for you and your practice. First, COVID-19 battered your revenue. Now you’re probably still facing supply-chain challenges and dealing with world-wide record inflation — 8.2% year-over-year in the U.S. alone. So how do you work to minimize the combined impact on your bottom line?

Here are six ways to help inflation-proof your business by thinking outside of the box. This way, you can afford to keep delivering value-driven care to your patients…who need it now more than ever.

Climb ev’ry mountain

As the graphic below starkly shows, it’s been a rough climb financially…for both you and your clients. If your income looked like this, you’d be thrilled. Instead, it shows the increasing cost of keeping your doors open.

A report released this summer by the Medical Group Practice Association (MGMA) confirms it: 90% of medical practices have reported that their costs have risen faster than revenues in 2022, and only 60% of medical practices hit their revenue goals in 2021. In an industry meant to treat suffering, it’s been downright painful.

Remember that not only have your practice’s costs gone up fast and furious, so are those of your patients and staff. When people are forced to spend a lot more than usual on essential goods like food, housing, gas and utilities, they must re-evaluate their budget and make some hard choices. Those often include putting off services such as medical or dental care. It also often means eating less-healthy, carb-heavy food, and saving money short-term by skipping needed car maintenance.

For those you serve, it can also mean putting off health maintenance. Patients delay an office visit, lab or radiology tests and ration out their medications against your recommended regimen. The result? Your practice has fewer visits by sicker and more-stressed patients, who consume more resources than they can afford. It’s a bad combination all around.

So how can you help them…and you?

- Reach out — For most people, financial and emotional stress take a toll on physical health as well. If you don’t do so already, take the initiative to perform proactive patient outreach. Especially if you haven’t seen a client for a while, ask them how they’re doing. Some of them have lost jobs and potentially employer-based health insurance and may be embarrassed to say so unless you thoughtfully but directly ask.

Discuss with them how to implement a personalized nutrition and lifestyle plan to optimize eating habits and activities that will optimize health. A webinar could be the most cost-effective way to offer these suggestions to a group of interested patients, and can be communicated easily through the practiceQ™ client portal. - Rethink your pricing — If you don’t have a pricing strategy that meets their needs as well as yours, make changes to it pronto! In another blog, we discussed the benefits and guidelines of a sliding-fee schedule, especially for patients who now lack health insurance. Perhaps it’s time to offer telehealth as a lower-cost alternative to some services. practiceQ supports a number of telehealth options to make it possible.

It’s better to see and help more people, sooner, than fewer patients who are sicker and require more staff time. Share the availability of such a program and its general guidelines in patient communications. It’s easy to send out communications through the practiceQ client portal!

As you evaluate your pricing structure, take a look at new revenue opportunities such as low-cost memberships in nutrition or exercise programs, discount “deals” in lab or radiology testing packages, and other services with limited direct costs that can help bridge patients’ health gaps. - Better leverage group-purchasing — If you run a small practice, examine what relationships you may not be leveraging to their fullest potential. Whether it’s a separate practice to which you send referrals, a local chamber or other membership or a national association of your peers, there are relationships you probably already have that you could better use for group purchasing of supplies, even discounts for equipment, shared services or more. It’s time!

- Go where your patients are…and vice versa — Examine the analytics of your patient base. Where do they live and work versus where your office or offices are located? A health fair in one or more centralized locations offering discounted services will not only serve the community but could bring in more revenue than it costs. And the greater visibility it generates might grow your patient base as a savvy marketing initiative!

If traffic is terrible during the standard work week, as it is in most metropolitan areas, consider Saturday or even Sunday-afternoon hours on a regular basis — maybe once or twice a month — to make it easier for patients to get to you. Evaluate your own patient volumes; if a day or afternoon are perennially slow, closing during those times could help pay for the shift in your availability to non-traditional hours.

- An eagle eye on budget and financials — When’s the last time you really looked at your budget with a critical eye as to how it’s working for you today? Things have changed so rapidly that perhaps your resources are misaligned with the current reality. What expenses can be cut or delayed…and how can those resources be shifted to higher-volume, revenue-generating services?

- Prioritize efficiency and technology — How well are all aspects of your business working together cost-efficiently and effectively? Are you leveraging all of the technology — including practiceQ — that you can use to further streamline your operations? You’re probably overdue for the investment of your time in an operational review.

- Retain satisfied staff — Leveraging technology and getting rid of the “glitches” that frustrate staff and slow down your patient flow also helps you retain those staff. Millions of burned-out people have left their jobs, never to return. We all know that recruiting and training new personnel is expensive, as is the cost of reduced productivity while they get up to speed. Keep the high-producing ones you have happy!

As always, staff are an asset that should always be considered as such. Yes, if there’s a person or persons not meeting expectations, you must address that through counseling which may include a 30-, 60- or 90-day action plan. It’s an investment you must make as an owner and/or manager and remember that the cost of hiring and training a new team member can’t be overlooked.

But if someone is bringing down your team’s productivity and you’re not addressing it, the others know…and be less likely to give their all when they’re hamstrung by a slacker who seems to be getting away with it. Productivity is a team effort, and all staff must demonstrate the same level of commitment to achieve and maintain it.

Cutting costs, fulfilling your mission and building brand loyalty

These steps and more will help you cut unnecessary costs while enhancing operations and fulfilling your mission to optimize health. You’ll also build even-stronger customer and staff satisfaction and loyalty in the process. Patients will appreciate the help both now and when their finances and/or health-insurance coverage stabilize. And as they rave about your practice’s concern with their well-being and recognition of financial challenges, they’ll be among your best ambassadors. So you could be improving health, saving money and growing your client base in the process!